Is the Consumer Price Index (CPI) a Scam? An MBA Economist’s Perspective

B-School Search

For the latest academic year, we have over 250 schools in our BSchools.org database and those that advertise with us are labeled “sponsor”. When you click on a sponsoring school or program, or fill out a form to request information from a sponsoring school, we may earn a commission. View our advertising disclosure for more details.

Doesn’t it seem like a couple of hundred dollars no longer fills a grocery basket like it used to not long ago at Whole Foods Market, Safeway, Costco—or even Walmart? Suddenly, Americans are experiencing a sense of disbelief that’s new for many and rarely seen in this country since the early 1980s. It’s known as receipt shock.

Signs of receipt shock abound. Puzzled grocery shoppers who usually throw their receipts away now linger on their way to store exits, all the while searching for barcode scanning errors during impromptu audits that would impress CPAs. At the next stop on many of these trips, a typical 18-gallon gas tank that shoppers could fill up for only $40 during the first Covid lockdowns in February 2020—when nobody drove—now requires double or even triple that much money in expensive areas of California, like Beverly Hills.

To be sure, the inflation statistics reported by the federal government are higher than they’ve been in years. But the figures carried by mainstream media news reports still don’t even remotely approach the skyrocketing prices that shoppers now experience, resulting in the public’s belief that actual inflation now runs well above the government’s reporting. This disconnect—the growing gap between buyers’ perceptions and the government’s reality—has consumers wondering, “how can this happen?”

Simply put, this perception gap exists because quiet changes in government statistics now reflect academic constructs devoid of relevance to shoppers’ use of those statistics in the real world. Even savvy shoppers like MBAs and our other BSchools readers usually lack awareness or understanding of these changes.

The CPI: What Our Professors Didn’t Teach Us

All national governments estimate inflation rates within their national income accounting programs. In the United States, the main measure of inflation remains the Consumer Price Index, or CPI. This index has been produced by the Department of Labor’s Bureau of Labor Statistics each month during the post-World War II era, and previously for another half-century under other names.

Most of us in the management education community—including undergraduate, MBA, and specialized business master’s degree students and alumni—originally learned about the CPI during our undergraduate Economics 101 macroeconomics principles coursework. There, we learned that this index is the most widely observed and applied measure of inflation across America.

The BLS calculates the CPI by comparing the prices of a fixed, standardized “market basket” of goods and services over two different time intervals. In essence, the inflation rate equals the CPI’s percentage growth from one year to the following year. This calculation yields the value we frequently observe in the press.

Our professors and teaching assistants taught us that as originally conceived, the CPI was intended to assess the cost of maintaining a standard of living that’s constant. That way, one could accurately compare those costs across months, years, or even decades. As such, the index accurately and completely measured the effects of inflation—and during a rare couple of years, deflation—for Americans’ out-of-pocket outlays.

Moreover, we learned that the CPI also encompasses several components that function as proxies for measuring inflation in different contexts. Some of these components are intended to display the degree of inflation experienced by key demographic buyer segments.

One such group includes urban buyers tracked by the CPI-U index, which focuses on the purchase experiences of buyers in cities because those areas tend to have higher costs for rent and energy than rural farm communities.

We also learned that the most frequently cited component of the index is the Core CPI, which omits food and energy prices from the market basket. That’s because food and energy products tend to display volatile price fluctuations that can bias the overall index. For example, weather conditions like droughts can result in temporary speculation in commodities markets that can drive up prices of goods like wheat and soybeans for temporary periods. Excluding these often results in a more stable overall index.

Surprisingly, the treatment of the CPI in most of these economics courses is stylized, and as we’ll see in this report, their coverage doesn’t reflect how radically the index has changed in recent years.

For example, more future executives have studied Economics by Dr. Campbell McConnell of the University of Nebraska than any other economics textbook over the last 50 years. Nevertheless, as late as 2019, the 21st-edition of that textbook, for the most part, presented the CPI as if it were still 1982—the year before the first changes started to impact the index.

This is one reason why so many college grads and MBAs don’t understand the disconnect they’re now observing between the prices in their shopping baskets and the CPI: nobody told them about all the behind-the-scenes, under-the-radar changes that radically transformed the index. Those changes are controversial because they exert profound effects on the measurement of inflation in the United States.

The Modified CPI Washington’s Elected Officials Want

Every federal elected official has a vested interest in a Consumer Price Index that understates the true inflation rate by as much as possible. Why? Several motivations exist, but let’s talk about the two main drivers. They relate to the financial markets—especially the credit market—and government transfer payments.

First, other things equal, a lower inflation rate typically indicates a more robust overall economy, and that perception is critical to keeping both voters and investors happy. Only a couple of unusual periods in American economic history resulted in undesirable deflation, like the Great Depression and the 2008 Great Recession. So overall, lower inflation is usually the objective of policymakers at the federal level.

Now, suppose that the true inflation rate exceeds the CPI as calculated by the Bureau. In that case, investors will realize a disappointing real (inflation-adjusted) rate of return that falls short of their expectations. That’s because unexpected inflation eats away at their gains.

For example, during the early 1980s, cash management accounts and money market funds were paying as much as 12 percent annual interest. However, many of those investors were actually losing money because across the nation, the overall inflation rate was even higher—about 15 percent.

But second, here’s the driving factor that can make or break Washington’s political careers: to optimize the economy’s performance, federal elected officials need to satisfy their constituents’ expectations while minimizing government transfer payments for a broad range of entitlement programs.

Social Security is the classic example. It’s not relevant to elected officials how reducing Social Security payments might improve economic growth, because that’s a step they’ll never attempt. This is a “third rail” program because its beneficiaries will destroy the re-election chances of any politician who votes to lower Social Security benefits.

However, through COLAs—cost of living adjustments—the Consumer Price Index is inextricably linked to such entitlements. A lower CPI will result in lower transfer payments—diminished costs that reduce government spending on programs like Social Security without any political risk to elected officials.

The Boskin Commission

Politicians aren’t stupid—they very well understand these dynamics. Not surprisingly, starting in about 1983, they’ve consistently exerted pressure on the BLS to increasingly understate inflation measurements.

But it wasn’t until 1995 that those efforts gained momentum when Federal Reserve Chairman Alan Greenspan testified before Congress that he believed the CPI overstated the growth in living costs. House Speaker Newt Gingrich then started to push for changes to the index.

At the time, Gingrich and his Republican allies were some of the most hated politicians in the country because their stubborn refusal to approve a continuing budget resolution actually shut down the federal government. They didn’t expect such a fierce political backlash would result; they needed damage control, and were searching for a face-saving way out. They found it in pronouncements by Dr. Greenspan and Stanford professor of economics Michael Boskin, who chaired the Council of Economic Advisors under President George H. W. Bush.

Dr. Greenspan and Dr. Boskin both advocated lower spending on Social Security to provide Gingrich with the “maneuvering room for budget negotiators” that he wanted through a “more accurate” Consumer Price Index. A New York Times story in September 1995 reported:

. . .economists believe one of the most important [CPI upside biases] is when consumers shift their buying patterns in response to changing prices, substituting one product for another. The index is based on a fixed market basket of goods and services. But, for example, if the price on an item like steak gets too expensive, consumers may switch to hamburger.

The Senate Finance Committee then appointed a special commission chaired by Dr. Boskin in 1995 to review the way that the BLS was calculating the CPI. Known as the Advisory Commission to Study the Consumer Price Index, it was only the second such Congressional investigation ever conducted in history.

The commissioners comprised an all-star “dream team” of the biggest names in economics. Besides Stanford’s Dr. Boskin, the superstars included two Harvard University professors: Dr. Zvi Griliches and Dr. Dale Jorgenson, who served as the chairman of Harvard’s Department of Economics. The commissioners also included Dr. Robert Gordon, the chairman of the economics department at Northwestern University.*

The CPI Under Fire

Nevertheless, the Boskin Commission enabled changes to the CPI that have drawn harsh fire from critics. One vocal detractor is William Ackman, the billionaire founder of the activist Wall Street hedge fund Pershing Square Holdings and a Harvard MBA. As reported by Bloomberg, in December 2021 Ackman tweeted:

Housing inflation is unlikely to abate based on supply and demand trends. The inflation that households are actually experiencing is raging and well in excess of reported gov’t statistics.

But an even more ardent critic appears to be John Williams, a Dartmouth College graduate who holds an MBA in economics from the Tuck School of Business. Based north of San Francisco, Williams has managed an economics consulting firm for Fortune 500 clients since the 1980s, and since 2004 he’s also produced the widely-quoted economic statistics and forecasting website Shadow Government Statistics.

Williams faults the Commission for permitting for the first time—and as foreshadowed by the above Times story—market basket substitution during the estimation process in response to changing consumer preferences. In that way, the BLS can substitute chicken for steak in its estimation basket if steak prices become expensive. That might help reduce government entitlement spending because, in contrast to the inflation rate measured by the fixed basket, the substituted basket lowers the reported inflation rate.

However, the change also defeats the purpose of maintaining a consistent market basket of products—and that is the only effective methodology that permits accurate comparisons of inflation rates over time. According to Williams,

The examples used in arguing for changing the CPI clearly were tied to prices rising and resulting consumer demand shifting to a lower-quality product. Simply put, that was the destruction of the cost of maintaining a constant standard of living concept and was the primary consideration of those seeking to change the CPI, although other issues would come into play. The drive here was to get a lower inflation reading, irrespective of whether the data were “more accurate.”

But substitution wasn’t the only Commission recommendation the BLS implemented. First, the Bureau decided to reselect goods and services in the market basket every two years instead of ten; the argument for doing so was that the agency needed to factor in the prices of new products rapidly adopted throughout the economy, like smartphones.

However, critics charge that choosing a different basket every 24 months provides many more opportunities to add cheaper products to the index, even if they’re not popular sellers.

Next, the BLS introduced price adjustments for “hedonic” quality improvements. In cases where the government believed that a product’s quality improved—the usual situation—it frequently reduced the product’s price that it applied in CPI calculations. In other words, the BLS stopped using market prices for all its CPI calculations but instead used costs kept in a “second set of books” based on the agency’s own opinions.

But where the CPI train really flew off the rails relates to the Bureau’s valuation adjustments for shelter, which accounts for a quarter of the total current inflation reporting in the CPI-U index. Before 1983, the BLS factored the actual market prices of homes into the index, but these days relies on a curious construct known as Owners’ Equivalent Rent (OER). According to Williams, the BLS estimates housing costs based on what homeowners theoretically would pay themselves to rent their own homes to themselves—then estimates each month how much homeowners raise rents on themselves! Says Ackman:

Reported inflation is understated. Owners’ Equivalent Rent (OER) relies on owner surveys to estimate inflation in housing costs. This is an extremely imprecise metric. The single family rental market provides more accurate data. OER in today’s reported Core CPI was [only] 3.5% [year over year].

Is the Consumer Price Index a Scam?

We may have used a touch of editorial license in this article’s title. Strictly speaking, the Consumer Price Index isn’t really a “scam” like criminal fraud or racketeering schemes. After all, it’s doing what Congress and policymakers intend it to do. It’s performing precisely in the ways that the BLS intends—and the results it produces reflect those policy decisions.

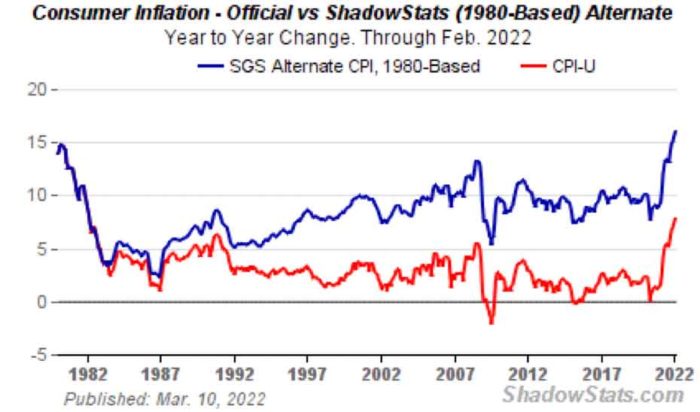

But does the CPI accurately reflect real-world public perceptions? Ackman and Williams argue that it does not. Take a close look at the following graph:

This is not an illusion. This is an accurate representation of the U.S. inflation rate, calculated using two different models.

The red trend line reflects the Urban Consumer Price Index calculated using the current BLS estimation model. The right axis of the graph shows that the current CPI-U at the time of this writing in February 2022 is just slightly less than 7 percent. This is the figure currently reported by mainstream news outlets.

However, the blue trend line embodies the CPI derived by Williams using the BLS estimation model in effect during 1980. Williams converted the differences between the updated BLS models and the 1980 model into constants, then applied those constants to adjust the trend line. The right axis shows that the February 2022 inflation rate, applying the model in effect during the nearly quarter of a century between 1961 and 1983, is actually about 16 percent.

Think about that fact. Let that 16 percent sink in for a moment.

This is the real reason why that $200 we mentioned at the beginning of this article doesn’t buy as much at the supermarket as it did only a few months ago. Calculated using a more authentic estimation model traditionally applied by the BLS—one that accurately reflected the public’s real-world perceptions in 1980—this estimate is roughly equivalent to the stratospheric inflation rate Americans were struggling with at the beginning of the Reagan Administration.

All in all, that 16 percent inflation rate better explains the price increases we’re all paying today.

* A few years ago, I had the privilege of talking with Dr. Gordon after an address he delivered to the Northwestern Club of San Francisco co-sponsored by the Kellogg School of Management and Charles Schwab Corporation, one of the largest employers of MBAs in the Bay Area at the time. Many of the justifications for the Commission’s recommendations that Dr. Gordon summarized in that speech appear in his paper published by the National Bureau of Economic Research, “The Boskin Commission Report and its Aftermath.”